“What makes a great finance team?”

This question is posed immediately in the first headline on the first page of the report “How the Best Finance Functions Work Today,” which presents the findings of PwC’s fourth round of benchmarking surveys of effective finance functions in Norway.

Over 60 Norwegian companies participated in 2023, and more than 6,500 data points were collected to provide insights into what characterizes the most efficient finance functions that succeed in becoming strategic business partners.

“The top 25% finance functions are over four times more cost-effective than the average.” Source: Benchmark Effective Finance Functions 2023

“It’s important to mention first that the top teams, as defined in the report, are the most cost-effective,” begins Vilde Skaansar, Manager at PwC Norway.

“The report uses a recognized measure of cost-effectiveness, where we look at total costs related to running the finance function against the company’s total revenue.”

What Sets the Top Teams Apart from the Average?

The report shows that there are mainly five things that stand out among the top 25% finance functions:

Looking at multiple benchmark surveys from 2018 to 2023, it becomes clear that technology is the main driver of cost-effectiveness. However, it’s important to remember that the use of technology cannot be achieved in a vacuum. Process ownership, defined roles, standardized processes, and a focus on competence development constitute the foundation that enables the effective use of technology.

“Our hypothesis is that you cannot fully exploit available technology if you don’t have the other elements in place,” emphasizes Skaansar. “You could say that the first four are prerequisites for achieving what might be the most important thing, which is utilizing available technology. That’s where you can gain the most, but you can’t do it without having everything else in place.”

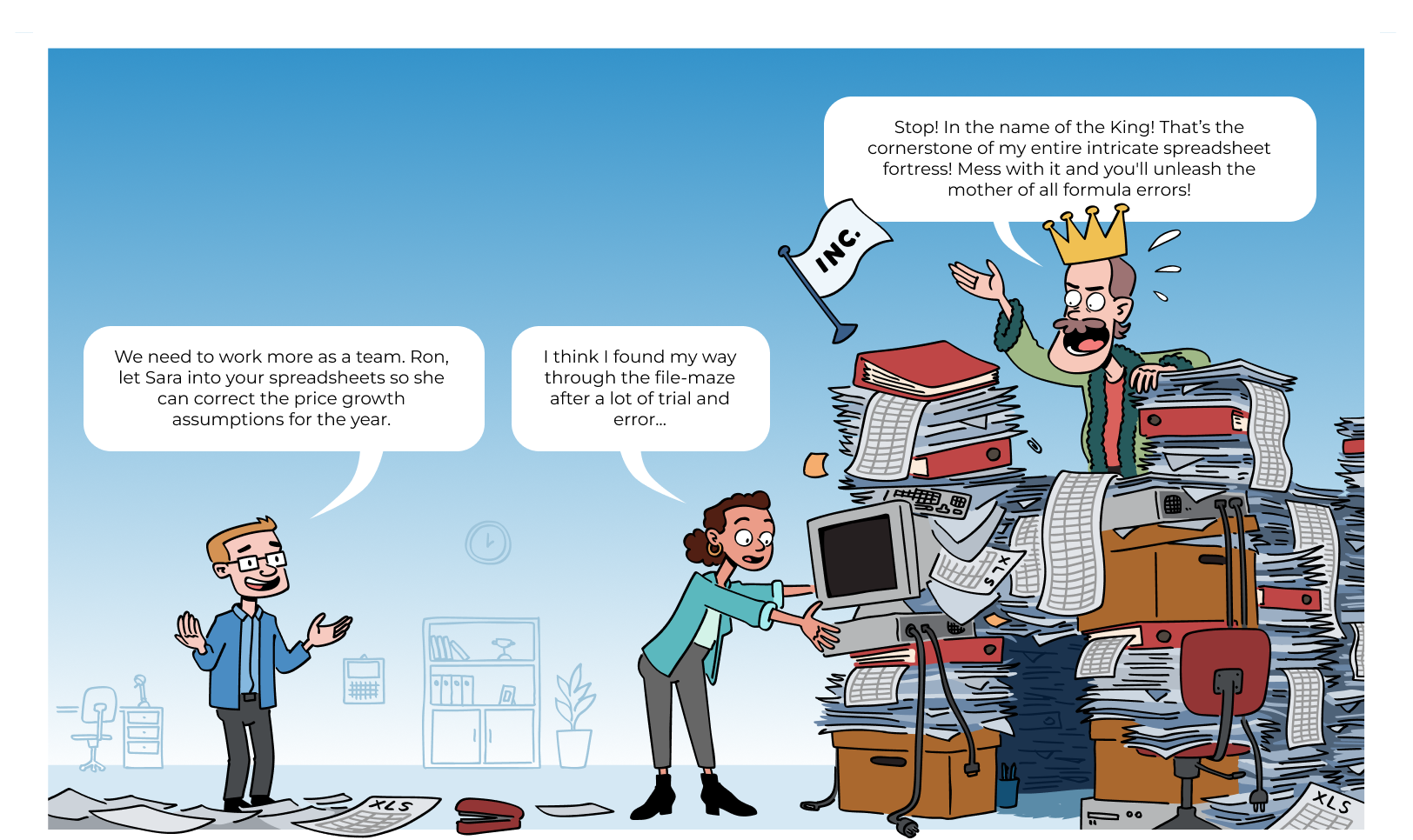

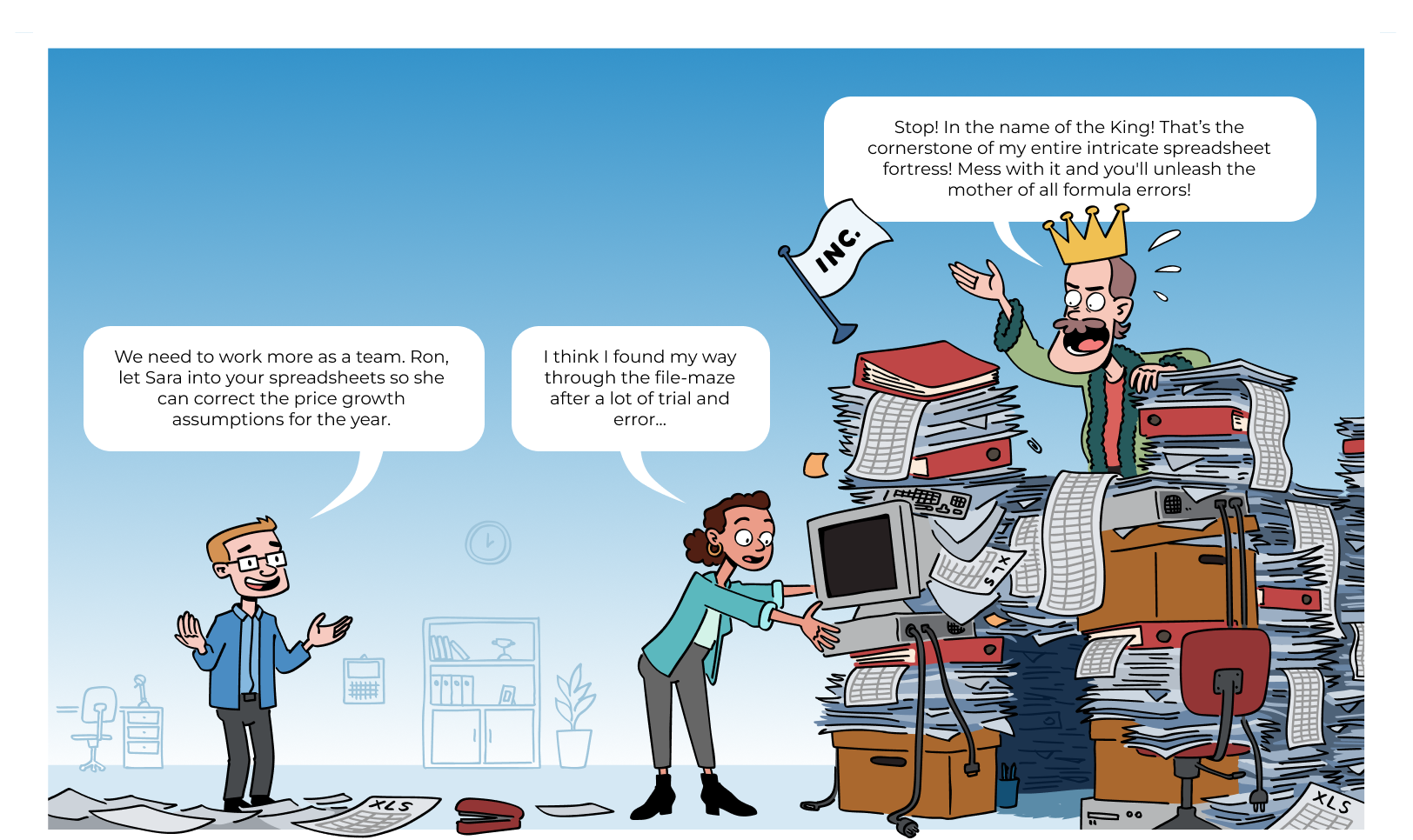

Team Building and Collaboration Lead to Value-Creating Work

“Financial management is a team sport.” Skaansar’s colleague, Marianne Kurås, has no doubt. As Director at PwC’s CFO Solutions, she has helped many companies develop their competencies, optimize their finance functions, and acquire systems.

“To be among the best, you need to collaborate well. That requires processes and routines, and a well-functioning financial system as a foundation. If you have good, streamlined processes supported by automation, the people in the finance function can focus much more on value-creating activities.“

The desire and need to have more time for value-creating activities have been on the CFO’s agenda for a long time. This is linked to the increasing demands on what the finance function should deliver.

“From a management perspective, it is expected that the finance function acts as a strategic business partner for operations,” says Skaansar. “They should provide good analyses and strategic insights that enable the entire company to operate at a better level.”

“Among the more average finance functions, a lot of time is still spent finding, compiling, and maintaining data,” continues Kurås. “This is not value-creating work. The best are more capable of freeing themselves from transactional tasks. When these things are automated and flow smoothly, you get more time for value-creating work such as predictive analyses.”

The top performers continue to widen the gap from the average

Just like an athlete who wants to be the best in their sport, there are no shortcuts for finance functions that want to be among the top 25%. This requires long-term commitment in the form of strategic restructuring and investments in new technology.

But according to PwC’s benchmark report, the gains from working long-term are a gift that keeps on giving.

“We see from previous surveys that the best are getting better,” says Skaansar. “They have greater improvements in cost-effectiveness over time. Our hypothesis is that they increasingly reap the benefits of working on processes, roles, responsibilities, and competence building. This enables them to exploit more of the potential in available technology and find new areas for efficiency by being proactive in adopting new technology.”

For finance functions considering embarking on such a journey, it is easy to go straight to acquiring new systems. But it’s important to remember that technology is just the tip of the iceberg in terms of the visible value of time and money saved by performing tasks and processes. What lies beneath the surface – process ownership, defined roles, standardized processes, and a focus on competence development – is far larger and forms the foundation on which the technology rests. Without this foundation beneath the surface, you will not be able to realize the full potential of the technology.

“But considering what the best are doing, the report shows that they manage to focus on competence development, processes, etc., and work long-term on this to ensure that both the organization and the employees have the right skills to be better equipped for change,” says Kurås.

Change Process and Investment in Technology

With the basics in place, the finance function will sooner or later reach the point where the timing is right to invest in new technology such as cloud-based ERP systems, BI tools, or planning tools. But how do such investments fit into the picture when efficiency is measured by looking at total costs related to running the finance function against the company’s total revenue?

“An investment in a system can often lead to slightly higher costs in the short term, and it can also require a lot of focus for the finance function for a period,” explains Kurås. “When it comes to how quickly you see results, it depends on good planning and execution of the project, supported by good change management. If you do this well, you can expect an improvement in efficiency in several areas relatively quickly after going live with new systems.”

Another way to look at the cost and return on investment in new technology is to take a lesson from an old Chinese proverb, which says that the best time to plant a tree was 20 years ago. The second-best time is now.

“I would like to emphasize the importance of change management,” says Kurås. “You can’t continue to do processes the way you did before when you change systems. You have to adapt more to the standardized solutions.”

The Future Finance Function

Another central theme for why one should learn from the best finance functions is the importance of having your own finance function perform at its best today and be equipped for tomorrow’s challenges. Given how fast developments are moving, it is also natural to look at how this will affect expectations of the finance function and changes in roles in the short and long term.

“International studies show that positions in bookkeeping, payroll, and accounting and the more traditional roles will be reduced in the coming years,” says Kurås. “At the same time, we see an increase in positions within business intelligence, for example. There will also be higher demands for ESG reporting, and the report shows that many expect the finance function to take responsibility for this.”

“We are also very focused on AI at the moment,” continues Skaansar. “Based on what we have seen technology giants showcase and start to roll out, we believe AI will change the way work is done in the finance function. This will happen very quickly, and for those in a position to take advantage of this, it will lead to significant efficiency improvements in the short term.”

Skaansar elaborates by using the controller role as an example. For this type of position, an AI co-pilot will likely assist with creating dashboards, analyzing data, commenting on insights, and connecting to other data previously unavailable to uncover opportunities and threats. This means the controller role will shift from manually compiling and maintaining data to knowing how to use these tools effectively, analyzing, and quality-assuring reports.

“As for the CFO, this role will increasingly be required to deliver real-time insights and predictive analyses that can form the basis for strategic decisions,” concludes Kurås. “The CFO area and the finance function as a whole are expected to be more proactive rather than reactive and much more of a sparring partner to the organization than they have historically been.”