The time of a fixed and predictable forward rate, known two days ahead of the interest period, has ended. For finance professionals responsible for large and complex loan portfolios, this has triggered five stages of grief.

The initial stages were denial and anger over the rate-fixing scandals, leading lawmakers and regulators to introduce a new family of interest rates known as Risk-Free Reference Rates (RFRs) with the aim of ensuring a credible reference rate for the global financial system.

Then came the bargaining stage, which led to USD LIBOR being artificially sustained through various time-limited synthetic LIBOR substitutes, particularly concerning those with existing loans, after its last quotation on June 30, 2023.

But now, we face the final stages of this process, with depression and an inevitable acceptance that the transition to SOFR is a reality.

Going forward, you must manage daily floating rates with more complex calculation methods such as ‘Lookback – with or without Observation Shift’, ‘Simple or Compounded Interest’, ‘Rounding Annualized Decimals’, ‘CAS’, ‘Floor’, and ‘Delay Payment Days’ make it more challenging to continuously calculate both accrued interest and the final term due.

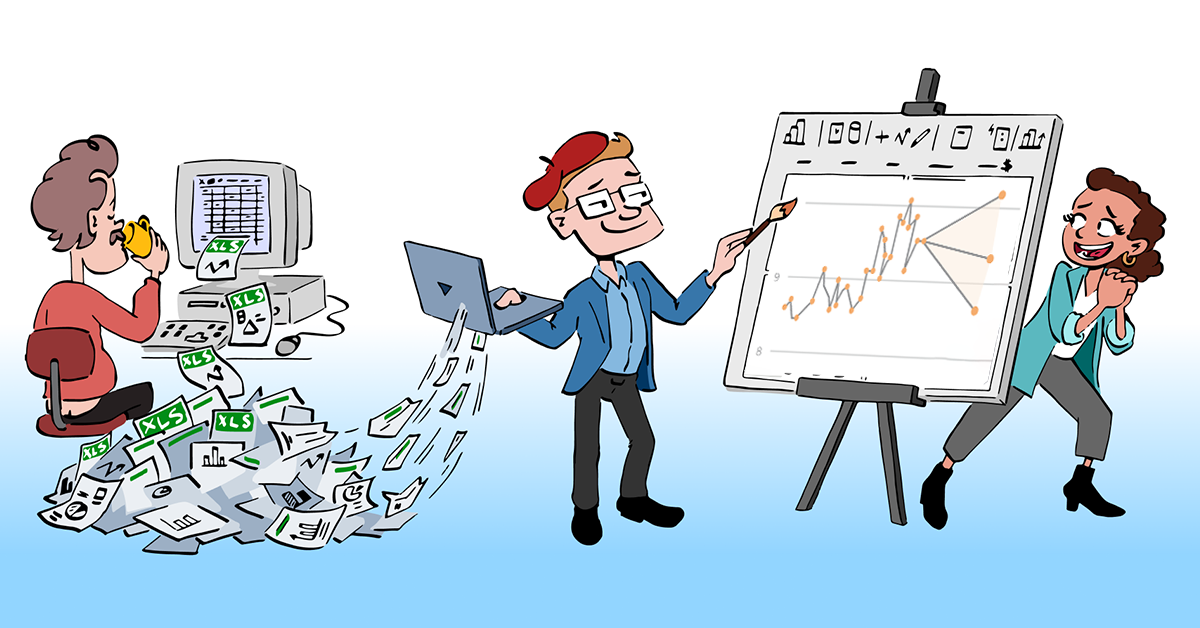

The increased complexity of the new interest rate landscape comes with major implications. While it was possible (but not without considerable risk) to rely on spreadsheets under LIBOR, manual number crunching under SOFR will be like accomplishing the thirteenth Labour of Hercules.

If spreadsheets are your only tool for managing loans in 2024, you should have very good answers to these questions:

The Loan Portfolio Manager represents one of the most sophisticated software tools we have ever developed, tailored to precisely tackle these types of challenges.

With over 60 integrated reports and the ability to handle everything from fixed term rates to now complex SOFR calculations, this module provides the finance department with the necessary tool for accurate calculation and accounting of debt and loan data. This applies to RFR interest rates in currencies other than USD: ESTR (EURO), SONJA (GBP), AONIA (AUD), SARON (CAD), SORA (SGD), SARON (CHF), TONAR (JPY).

As an integral part of the CFO Platform, it can also be combined with budget and forecast solutions for a consistent and coordinated system for all financial planning and analysis.

Whether it’s a shipping company with complex debt and corporate structure, with debt in various currencies linked to underlying ships, or other types of businesses with similar issues, or just a simple company with SOFR rates, the Loan Portfolio Solution is adaptable and ready for implementation. For customers with specific needs, we tailor the solution to ensure seamless integration into their existing systems. The main benefits you gain by using the

Finance departments now stand at a crossroads, ready to close the book on LIBOR and open a new one with SOFR. With the Profitbase CFO Platform and Loan Portfolio Solution, this transition becomes an opportunity to improve and streamline how loan portfolios are managed.

Fill out the form and download a more descriptive product sheet about the Loan Portfolio Solution or contact us today for a closer discussion on how Profitbase can assist in elevating the finance function from manual and vulnerable number crunching to a digitized strategic powerhouse for the business.